GST FILING AND REGISTRATION

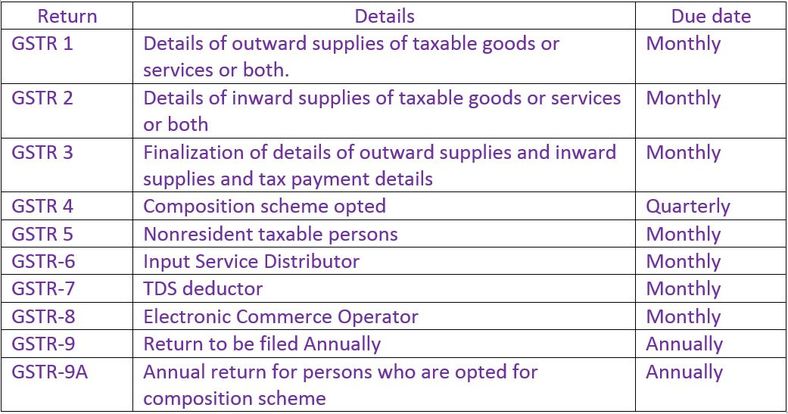

Every registered dealer under Goods & Service Tax should file GST return within their specific due dates like Monthly/Quarterly.

GST returns includes Purchases and sales by registered dealer & Output GST and Input tax credit. All invoices forming part of the business of the registered dealer shall include in GST returns.

GST returns includes Purchases and sales by registered dealer & Output GST and Input tax credit. All invoices forming part of the business of the registered dealer shall include in GST returns.

TYPES OF GST RETURNS APPLICABLE FOR VARIOUS DEALERS

GST REGISTRATION FOR FOREIGN COMPANY

As per Central goods & services act every Foreign company and every nonresident taxable person who involved in transactions relating to taxable supply of goods or services to the recipients in India, in such cases, a person is liable to register under Central goods & services act as a Principal or Agent or in any other capacity. Whether it’s a fixed place of business or not.

Foreign companies liable to register under Central goods & services act has to file GSTR-5 before due date.

Foreign companies liable to register under Central goods & services act has to file GSTR-5 before due date.

GST MIGRATION

GST migration is different from GST registration. In the process of GST migration businesses which are already existed and registered under Service Tax, Value Added Tax, Luxury Tax, Entertainment and Excise act Etc. are obtained. Provisional ID and password which given by Statutory Authorities.

To complete GST Migration Process along with documents required for registration of GST the following additional information is required.

To complete GST Migration Process along with documents required for registration of GST the following additional information is required.

- E Mail ID

- Mobile Number

- Bank account number and IFSC Code

ABOUT US

Our Company Registration associates are skillful in tax filing. We are the best in our profession, our primary motto abides by customers satisfaction. So we strongly recommend you to consult us to get your tax filed. we do offer other wide range of services like income tax filing, TDS RETURN, ESI return etc.,

LET'S MEET HERE

|

Address

StartBiz Private Limited

#202 Mah Manor Complex, Before Hotel Crystal Banjara, On Masab Tank to BanjaraHills Road- (Beginning) Hyderabad-500028 Phone

040-48501788

+91-9346567000 |